Bank brings in top QC to lead forex investigation

The Bank of England has drafted in a leading lawyer to head its investigation into alleged manipulation of the foreign exchange markets.

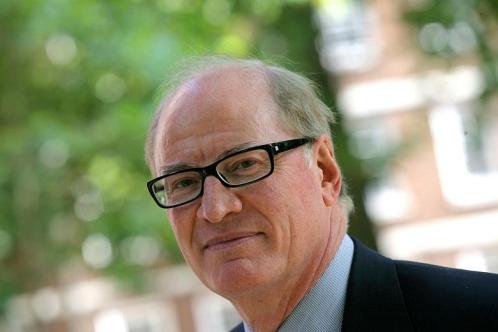

Lord Grabiner, QC, has been instructed to determine whether Bank officials helped to rig the currency markets or were aware that forex traders were doing so.

One commercial QC who has worked closely with Lord Grabiner described him as the silk to hire “if you needed someone to go in and do a clean-up job and you wanted one of the heaviest heavyweights possible”.

He added: “He’s a big, forceful, smart guy. He brings with him the authority of someone who is completely incorruptible, who won’t be swayed by whoever pays his fees.”

The QC suggested that Lord Grabiner charged £4,000 to £5,000 an hour for corporate investigations. However, this was likely to fall to about £3,000 an hour at the Bank of England. “The Governor will be getting mate’s rates.” The Labour peer is believed to earn £2 million a year as the head of One Essex Court chambers.

Lord Grabiner was appointed in 2011 as chairman of the committee set up to investigate phone-hacking at News International, the media company that became News UK, owner of The Times.

Threadneedle Street revealed last week that it had suspended an employee in connection with its investigation and had hired Travers Smith, a law firm, to conduct an internal inquiry. The firm will continue its work at the Bank under the direction of Lord Grabiner.

The Bank said that it would publish the outcome of its investigation but warned that publication would be delayed until the Financial Conduct Authority had concluded its investigation into the forex markets.

Lord Grabiner and Travers Smith will look into whether bank officials were involved in attempted or actual manipulation of the forex market, were aware of the practice, were aware of the potential for manipulation, colluded with traders to manipulate the market or were aware that traders were colluding to manipulate the market.

The lawyers will also investigate whether officials at the Bank shared confidential client information relating to the forex markets or were aware that such information was being shared.